Please note that the stats are mostly from 2012 as the fiscal 2013 year data has not been aggregated at the time of writing.

Market stats

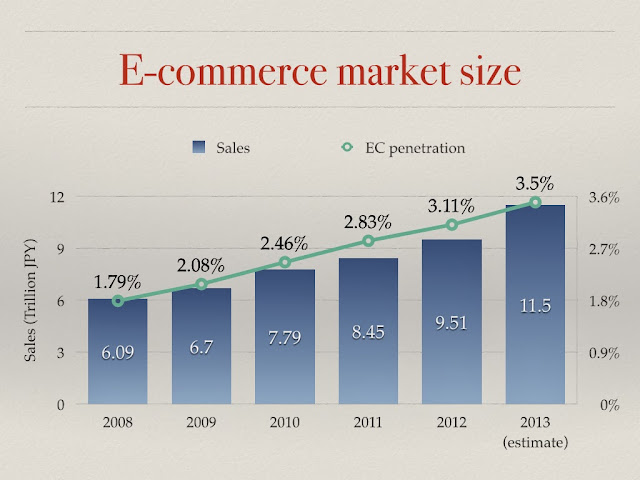

From 2008, Japan B2C e-commerce has continually thriving year by year at an annual rate of 9% steadily. By end of 2012, 9.51 trillion JPY has been achieved. By end of 2013, it is estimated that Japan B2C e-commerce market size will grow to 11.5 trillion JPY according to study. Being one of the largest retail and economic markets globally, the e-commerce penetration across various industries is surprisingly low, which suggests there is still much room in this market despite the already competitive e-commerce realm. While individual e-commerce startup operations often carry double digit growth, it is often due to the relatively small size. On the macro level, it is unlikely that we will be observing double-digit growth unless the e-commerce penetration rate accelerates tremendously.

When asked if one has ever used online shopping, over 90% of the respondents replied yes. Japan is one of the early adapted market for e-commerce. The form of e-commerce did not always base on PC-usage. In the case of Japan, the internet adoption was due to the advance features of cellphones during 90’s, as a result, the e-commerce in Japan was first introduced in the mobile form.

The general retail, travel, and F&B combined cover more than 33% of the entire B2C market. Foods alone covers 6.36% share, this is partially contributed by the increasing needs to stock food after 3/11 earthquake in 2011. Please note that the F&B service is different from foods, where F&B means reservation service, and foods represents grocery.

Looking from a different perspective, when asked about what type of products are purchased most frequently, print media, apparels, and food/drink/alcohol lead the top categories. The first two categories also appear as the most frequently purchased categories in other markets. Japan, being one of the frequently alcohol consuming countries, combined with the increasing needs for stocking foods, has driven the F&B categories as a frequent purchased category.

Speaking of the major consumer e-commerce platforms, there are roughly three main players in Japan.

- Rakuten

- Amazon

- Yahoo!

Rakuten is a platform that supports C2C business. Unlike the other two players, the business model is not only limited to the e-commerce platform. Rakuten in Japan has a healthy ecosystem consisted of point based CRM, EDM and most importantly the tied in financial system. Rakuten point works very much like cash, and is often appropriated to potential users for free from vendors as part of the marketing campaign. Further, merchant support from Rakuten is far more superior than others. Rakuten University is an institute geared towards educating merchants to further boost their sales.

Yahoo! Japan in order to attract more merchants to its platform, has begun offering zero commissions for all merchants. On one hand, it is a huge incentive for all merchants, on the other hand, it has been viewed that Yahoo! Japan is using its last resort to keep its foothold in this market.

The next post will be presenting the general user side of the story in the B2C e-commerce market.

Stay tuned.

沒有留言:

張貼留言